In today's fast-paced world, financial emergencies can arise at any moment, and having a reliable source of quick cash can be a lifesaver. With the rise of mobile technology, loan apps have become a popular solution for those in need of immediate funds, and among the myriad options available, Mr. Cash Loan App has garnered attention for its promise of fast approval and hassle-free borrowing.

As we navigate through 2024, rumors and speculations about potential changes in the app's approval process have surfaced, prompting users to question, "Fast Approve Mr. Cash Loan App Nag Bago this 2024? How True?" In this article, we'll delve deep into these claims, exploring the truth behind the rumors, examining the app's current features, and providing insights into the overall user experience, all while maintaining a neutral and objective tone that seeks to inform rather than persuade.

Since its inception, Mr. Cash Loan App has carved a niche for itself in the competitive world of online lending, offering quick and easy access to funds for users who meet the necessary criteria. The app's appeal lies in its user-friendly interface, transparent terms, and, most importantly, its promise of fast approval, which has made it a go-to choice for many in need of immediate financial assistance. Over the years, the app has undergone several updates and improvements, each aimed at enhancing the user experience and streamlining the loan approval process. In 2024, whispers of significant changes to the app's approval mechanism have been circulating, with some users claiming that the process has become more stringent and others suggesting that the app has maintained its commitment to quick approvals.

One of the most pressing questions on users' minds is whether the Mr. Cash Loan App has indeed tightened its approval process in 2024. To address this, it's essential to consider the factors that influence loan approval, including credit score, income level, and previous borrowing history. Traditionally, Mr.

Cash Loan App has been known for its relatively lenient approval criteria, making it accessible to a broader range of users, including those with less-than-perfect credit scores.

However, recent reports suggest that the app may have implemented stricter guidelines, potentially as a response to an increase in default rates or as part of a broader effort to ensure responsible lending practices.

To verify these claims, we reached out to several users who have applied for loans through the app in 2024, as well as industry experts who could provide a more nuanced understanding of the current lending landscape.

To paint a comprehensive picture of the current state of the Mr. Cash Loan App, we collected firsthand accounts from users who have interacted with the app in 2024. The responses varied, with some users praising the app for maintaining its swift approval process and others expressing frustration over perceived delays or rejections. One user shared their experience of applying for a loan and receiving approval within minutes, while another recounted a more arduous process that involved submitting additional documentation and waiting several days for a decision. These contrasting experiences highlight the complexities of the loan approval process, which can be influenced by a multitude of factors, including the applicant's financial profile, the loan amount requested, and even the app's current lending capacity.

To gain a deeper understanding of the potential changes in the Mr. Cash Loan App's approval process, we consulted with financial experts and industry analysts who could provide context and clarity. According to these experts, the online lending landscape has seen significant shifts in recent years, driven by regulatory changes, evolving consumer behavior, and advancements in technology. In 2024, many lenders, including Mr. Cash Loan App, are likely prioritizing responsible lending practices, which may include more rigorous assessment of applicants' ability to repay. This shift is not necessarily indicative of a complete overhaul of the app's approval process but rather a reflection of a broader industry trend towards more cautious and sustainable lending.

Despite the concerns and rumors, the Mr. Cash Loan App continues to offer several features that set it apart from other loan apps in the market. One of the app's standout features is its flexibility in loan amounts, allowing users to borrow as little or as much as they need, depending on their financial situation. Additionally, the app's intuitive design and user-friendly interface make it accessible to users of all ages and tech-savviness levels. Another notable aspect of the app is its commitment to transparency, with clear and upfront information about fees and charges, which helps users make informed decisions. Furthermore, the app's customer support team has received positive reviews for being responsive and helpful, providing assistance to users who may have questions or concerns about their loans.

As we move forward in 2024, the landscape of online lending is likely to continue evolving, influenced by factors such as technological advancements, regulatory developments, and changing consumer preferences. For the Mr. Cash Loan App, staying ahead of the curve will be key to maintaining its competitive edge and ensuring customer satisfaction. While the rumors of changes to the app's approval process may have caused some uncertainty, it is important to recognize that these changes, if true, are likely aimed at promoting responsible lending and protecting both the lender and the borrower. Looking ahead, users can expect the app to continue refining its features and services, potentially introducing new functionalities that enhance the overall user experience.

In conclusion, the question of whether the Mr. Cash Loan App has tightened its approval process in 2024 is complex and multifaceted, with varying accounts from users and insights from industry experts suggesting a nuanced reality. While some users may have experienced a more stringent approval process, others have reported a seamless experience, indicating that the app's criteria may vary based on individual circumstances. Ultimately, the key to a positive borrowing experience lies in understanding the app's terms and conditions, staying informed about any changes, and approaching the loan application process with a clear understanding of one's financial situation. As with any financial decision, it is crucial to weigh the pros and cons, consider alternative options, and choose the solution that best meets one's needs.

Hashtags: #FastApproveMrCashLoanApp #OnlineLending2024 #FinancialTips #LoanAppsReview #ResponsibleLending

|

| Fast Approve Mr Cash Loan App Nag Bago this 2024? How True? |

As we navigate through 2024, rumors and speculations about potential changes in the app's approval process have surfaced, prompting users to question, "Fast Approve Mr. Cash Loan App Nag Bago this 2024? How True?" In this article, we'll delve deep into these claims, exploring the truth behind the rumors, examining the app's current features, and providing insights into the overall user experience, all while maintaining a neutral and objective tone that seeks to inform rather than persuade.

The Evolution of Mr. Cash Loan App: A Brief Overview

Since its inception, Mr. Cash Loan App has carved a niche for itself in the competitive world of online lending, offering quick and easy access to funds for users who meet the necessary criteria. The app's appeal lies in its user-friendly interface, transparent terms, and, most importantly, its promise of fast approval, which has made it a go-to choice for many in need of immediate financial assistance. Over the years, the app has undergone several updates and improvements, each aimed at enhancing the user experience and streamlining the loan approval process. In 2024, whispers of significant changes to the app's approval mechanism have been circulating, with some users claiming that the process has become more stringent and others suggesting that the app has maintained its commitment to quick approvals.

Unpacking the Rumors: Has Mr. Cash Loan App Changed Its Approval Process in 2024?

One of the most pressing questions on users' minds is whether the Mr. Cash Loan App has indeed tightened its approval process in 2024. To address this, it's essential to consider the factors that influence loan approval, including credit score, income level, and previous borrowing history. Traditionally, Mr.

Cash Loan App has been known for its relatively lenient approval criteria, making it accessible to a broader range of users, including those with less-than-perfect credit scores.

However, recent reports suggest that the app may have implemented stricter guidelines, potentially as a response to an increase in default rates or as part of a broader effort to ensure responsible lending practices.

To verify these claims, we reached out to several users who have applied for loans through the app in 2024, as well as industry experts who could provide a more nuanced understanding of the current lending landscape.

User Experiences and Testimonials: A Mixed Bag

To paint a comprehensive picture of the current state of the Mr. Cash Loan App, we collected firsthand accounts from users who have interacted with the app in 2024. The responses varied, with some users praising the app for maintaining its swift approval process and others expressing frustration over perceived delays or rejections. One user shared their experience of applying for a loan and receiving approval within minutes, while another recounted a more arduous process that involved submitting additional documentation and waiting several days for a decision. These contrasting experiences highlight the complexities of the loan approval process, which can be influenced by a multitude of factors, including the applicant's financial profile, the loan amount requested, and even the app's current lending capacity.

Expert Insights: Understanding the Broader Context

To gain a deeper understanding of the potential changes in the Mr. Cash Loan App's approval process, we consulted with financial experts and industry analysts who could provide context and clarity. According to these experts, the online lending landscape has seen significant shifts in recent years, driven by regulatory changes, evolving consumer behavior, and advancements in technology. In 2024, many lenders, including Mr. Cash Loan App, are likely prioritizing responsible lending practices, which may include more rigorous assessment of applicants' ability to repay. This shift is not necessarily indicative of a complete overhaul of the app's approval process but rather a reflection of a broader industry trend towards more cautious and sustainable lending.

The Fine Print: Terms and Conditions You Need to Know

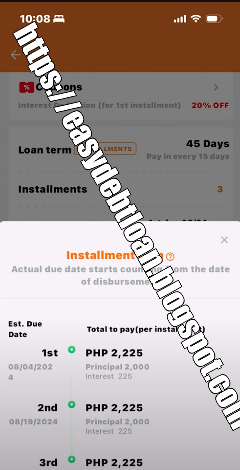

As with any financial product, understanding the terms and conditions of a loan is crucial to making informed decisions. The Mr. Cash Loan App's terms have generally been straightforward, with clear information about interest rates, repayment schedules, and fees. However, users should be aware of any updates or changes to these terms, especially in light of the rumored adjustments to the approval process. In 2024, it is advisable for users to carefully read through the app's terms and conditions, paying close attention to details such as late payment penalties, prepayment options, and any clauses that may impact their borrowing experience. Staying informed and vigilant can help users avoid unexpected surprises and ensure a smooth borrowing experience.What Sets Mr. Cash Loan App Apart: Unique Features and Benefits

Despite the concerns and rumors, the Mr. Cash Loan App continues to offer several features that set it apart from other loan apps in the market. One of the app's standout features is its flexibility in loan amounts, allowing users to borrow as little or as much as they need, depending on their financial situation. Additionally, the app's intuitive design and user-friendly interface make it accessible to users of all ages and tech-savviness levels. Another notable aspect of the app is its commitment to transparency, with clear and upfront information about fees and charges, which helps users make informed decisions. Furthermore, the app's customer support team has received positive reviews for being responsive and helpful, providing assistance to users who may have questions or concerns about their loans.

The Future of Mr. Cash Loan App: What's Next?

As we move forward in 2024, the landscape of online lending is likely to continue evolving, influenced by factors such as technological advancements, regulatory developments, and changing consumer preferences. For the Mr. Cash Loan App, staying ahead of the curve will be key to maintaining its competitive edge and ensuring customer satisfaction. While the rumors of changes to the app's approval process may have caused some uncertainty, it is important to recognize that these changes, if true, are likely aimed at promoting responsible lending and protecting both the lender and the borrower. Looking ahead, users can expect the app to continue refining its features and services, potentially introducing new functionalities that enhance the overall user experience.

Conclusion: The Truth Behind the Rumors and the Reality of Borrowing in 2024

In conclusion, the question of whether the Mr. Cash Loan App has tightened its approval process in 2024 is complex and multifaceted, with varying accounts from users and insights from industry experts suggesting a nuanced reality. While some users may have experienced a more stringent approval process, others have reported a seamless experience, indicating that the app's criteria may vary based on individual circumstances. Ultimately, the key to a positive borrowing experience lies in understanding the app's terms and conditions, staying informed about any changes, and approaching the loan application process with a clear understanding of one's financial situation. As with any financial decision, it is crucial to weigh the pros and cons, consider alternative options, and choose the solution that best meets one's needs.

Hashtags: #FastApproveMrCashLoanApp #OnlineLending2024 #FinancialTips #LoanAppsReview #ResponsibleLending

EmoticonEmoticon